Think you don’t have much time to study everything about personal finance management? There is a timeless lesson you can apply right away. This Ancient Financial Rule of Lord Buddha, originating from Lord Buddha over 2000 years ago, is still highly relevant in the modern world.

The rule is simple:

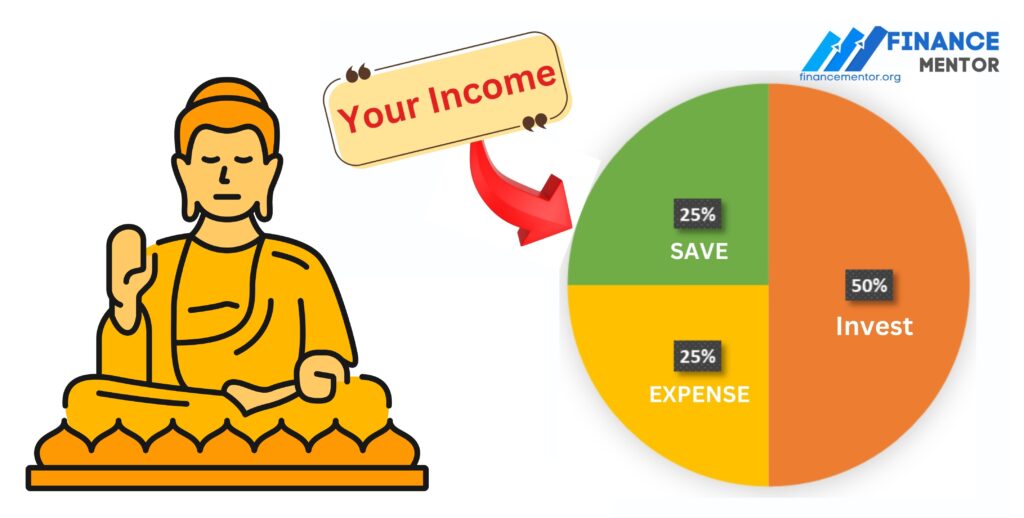

- Divide your income into four parts.

- One part should go towards your daily expenditures,

- Another for savings as an emergency fund,

- And the remaining two parts should be invested.

This straightforward and powerful rule helps foster great financial discipline, making it easier to manage your money with wisdom and balance.

While Lord Buddha is not directly associated with teachings specifically about financial management, his broader teachings on life, ethics, and personal discipline can be applied to financial practices. Here are some principles from Buddha’s teachings that can be linked to financial management: Other Ancient Financial Rule of Lord Buddha are,

1. The Middle Way (Moderation)

- Financial Application: The Middle Way teaches balance and avoiding extremes. In financial terms, this means not indulging in excessive spending or extreme frugality. It’s about maintaining a balance between enjoying life and saving for the future, ensuring financial health without deprivation or extravagance.

2. Right Livelihood (Ethical Earnings)

- Financial Application: Buddha taught that one should earn a living through ethical means, avoiding occupations that harm others. In finance, this can translate to making money in ways that are honest and ethical, avoiding exploitative businesses, and ensuring your financial actions do not harm others.

3. Contentment (Santosha)

- Financial Application: Buddha emphasized contentment and detachment from material possessions. Practicing contentment means being satisfied with what you have and avoiding the endless pursuit of wealth for its own sake. This mindset can help avoid the trap of consumerism and unhealthy financial competition.

4. Mindfulness (Awareness in Spending)

- Financial Application: Mindfulness in Buddhist practice involves being aware of your thoughts, actions, and decisions. In financial terms, this means being mindful of how you spend, save, and invest. It encourages deliberate, thoughtful decisions rather than impulsive spending or investing without understanding.

5. Non-Attachment (Avoiding Greed)

- Financial Application: Buddha’s teaching on non-attachment reminds us to not cling to wealth or possessions. This means understanding that money is a tool, not the ultimate goal, and not becoming overly attached to material wealth, which can lead to greed or financial stress.

6. Generosity (Dana)

- Financial Application: Generosity is a core Buddhist value. Financially, this translates to giving to others, whether through charity, helping those in need, or supporting community initiatives. Practicing generosity not only helps others but also cultivates a healthy relationship with money.

7. Impermanence (Change in Financial Circumstances)

- Financial Application: Buddha taught that everything is impermanent, including wealth and material possessions. Understanding that financial situations can change fosters preparedness, such as building emergency funds, diversifying investments, and not relying solely on current wealth for future security.

8. Simplicity (Living Within Means)

- Financial Application: Buddha advocated for a simple life free of unnecessary desires. In financial management, this means living within your means, avoiding debt, and focusing on needs rather than wants.

9. Karma (Financial Responsibility)

- Financial Application: Karma teaches that your actions have consequences. In finance, this means that how you handle money, whether through saving, spending, or investing, will determine your financial future. Practicing good financial habits leads to long-term success.

10. Discipline (Consistency in Financial Habits)

- Financial Application: Buddha emphasized the importance of discipline in spiritual practice. Financial discipline involves consistent saving, budgeting, and investing. It’s about sticking to your financial goals and avoiding reckless financial decisions.

This The Ancient Financial Rule of Lord Buddha is a powerful reminder that financial success doesn’t have to be complicated; sometimes, the simplest strategies offer the greatest rewards.

If you need learn more – contact me