Stock Market Bubble: Understanding How It Forms, Peaks, and Bursts

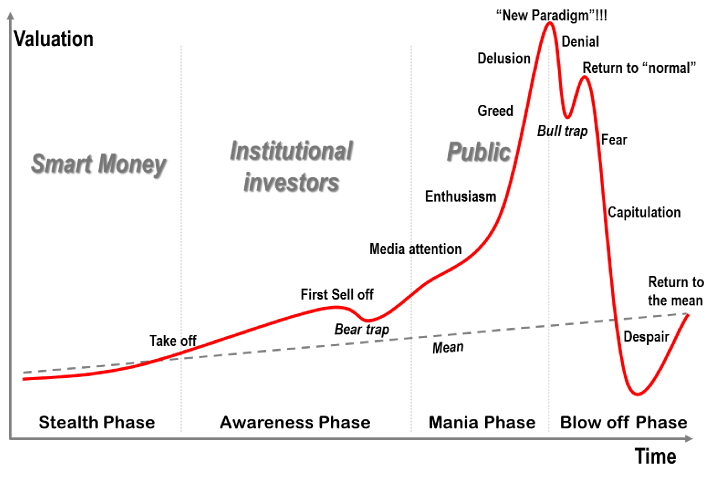

A stock market bubble is a phenomenon where stock prices soar far beyond their fundamental value, driven by factors like speculation, irrational optimism, and investor hype. Bubbles are fueled by the belief that prices will keep rising, attracting more buyers in a self-reinforcing cycle. Eventually, however, these inflated prices become unsustainable, resulting in a sharp market correction or crash. Let’s dive into how a stock market bubble develops, peaks, and finally bursts.

Formation of a Stock Market Bubble

The formation of a stock market bubble usually follows a predictable pattern involving increased demand, hype, and speculative buying. Here’s how it unfolds:

Increased Demand: Often triggered by hype or a major innovation, an industry or the entire market begins to attract more buyers. For example, during the late 1990s dot-com bubble, internet stocks saw massive investment as people speculated on enormous future profits. This demand, sometimes irrational, pushes prices higher.

Speculation and Hype: As prices rise, more investors are drawn in, hoping to profit from continued increases. Valuation metrics like earnings, revenue, and profitability may be ignored as people focus on short-term gains rather than the company’s actual financial health. This “get-rich-quick” mentality fuels a cycle of buying, further inflating prices.

Irrational Exuberance: Investors start to believe that stock prices will keep climbing indefinitely, despite the absence of solid fundamentals. Confidence grows to the point where even typically cautious investors may join, driven by fear of missing out (FOMO) on potential profits. This stage is characterized by a disregard for market risks, as rising prices reinforce the illusion of security.

Peak Phase of Stock Market Bubble

At the height of a bubble, stock prices reach levels that are wildly overvalued by traditional measures. This peak phase is marked by widespread investor euphoria:

Overvaluation: Prices are often far beyond any reasonable valuation, but investors justify it with the belief that the market will continue its upward trend. The dot-com bubble, for instance, saw internet companies with no profits being valued in the billions, purely based on growth expectations.

Fear of Missing Out (FOMO): The sense that “everyone is making money” becomes pervasive, encouraging even cautious investors to jump in. This late-stage buying further pushes prices higher, as investors pile into assets, hoping for continued gains.

Burst Phase of Stock Market Bubble

No bubble lasts forever. Eventually, reality catches up, and something triggers a reversal in sentiment, which leads to the bubble bursting:

Catalyst for Doubt: Any sign of weakness, such as poor earnings reports, regulatory concerns, or macroeconomic changes, can cause doubt about the inflated values. For instance, in the case of the dot-com bubble, many companies struggled to turn a profit, which led to a loss of confidence.

Selling and Panic: As investors realize prices are unsustainable, they begin to sell, triggering a chain reaction. The initial wave of selling is often followed by panic, as prices start to drop rapidly. Those who bought in at high valuations face steep losses, and the rush to sell further amplifies the decline.

Market Correction: Prices fall back toward their intrinsic value, often dropping sharply in a short period. This correction can lead to a bear market if the declines persist, as overvalued stocks continue to adjust to more realistic levels.

Aftermath of a Burst Stock Market Bubble

The consequences of a burst bubble can be far-reaching and long-lasting, impacting not only the affected stocks but also the broader market and economy:

Sustained Low Prices: After a bubble bursts, stock prices may remain depressed for years, as was the case with many tech stocks after the dot-com bubble. This prolonged downturn can hurt investor portfolios, particularly for those who bought during the peak.

Loss of Confidence: Investor sentiment can be shaken, with many avoiding the affected sector or stocks for years. This can lead to reduced investment, slower recovery, and a shift in market behavior.

Tighter Regulation and Investor Caution: A major bubble burst often leads to new regulations designed to prevent similar crises in the future. For instance, the Sarbanes-Oxley Act was introduced in response to corporate scandals and speculative bubbles, aiming to improve corporate governance and financial transparency. Similarly, the burst can foster greater investor caution, with a stronger focus on valuation and fundamentals.

Lessons from Stock Market Bubbles

Understanding stock market bubbles is essential for investors, as these cycles of boom and bust can have a lasting impact on financial markets. Here are some key takeaways:

Stay Grounded in Fundamentals: Assessing a company’s actual earnings, growth potential, and valuation metrics can help prevent irrational investments based solely on hype.

Recognize Speculative Mania: When sectors experience a rapid, sustained price increase with weak fundamentals, it’s wise to stay cautious and avoid getting swept up in speculation.

Diversify and Manage Risk: Investing across different asset classes and regions can mitigate the impact of a bubble burst in any single sector or market.

Avoid FOMO: Jumping into a rising market without sound reasoning can lead to losses if the bubble bursts. Patience and long-term thinking often yield better results than chasing quick profits.

By understanding these dynamics, investors can avoid the pitfalls of market bubbles and make more informed, sustainable investment decisions.

Examples of Famous Stock Market Bubbles: Click here