How it happened, the impact of them, learned lessons and how to

get ready and face them if it happen again – Major Economic Crises in the past three decades

Economic crises have shaped the global economy over the past three decades, driven by factors like excessive borrowing, geopolitical events, speculative bubbles, and public health emergencies. Each crisis had distinct causes, significant impacts, and long-term aftereffects, offering valuable lessons in economic resilience, regulation, and policy-making. Here’s an overview of nine major economic crises and their legacy.

1. 1997 Asian Financial Crisis

Cause: Excessive foreign borrowing and currency mismatches plagued many Asian economies, especially Thailand, Indonesia, and South Korea. These countries relied heavily on foreign loans, creating vulnerabilities when investor confidence waned.

Impact: Rapid currency devaluations hit the Thai baht first, spreading across Asia. Corporate bankruptcies and severe recessions followed, crippling economies and leading to widespread unemployment and social unrest.

Aftermath: The IMF stepped in with substantial bailout packages to stabilize these economies, imposing conditions that included austerity and structural reforms. Many affected nations implemented stricter financial regulations to enhance resilience and reduce reliance on short-term foreign debt.

2. Dot-Com Bubble (2000–2002)

Cause: A wave of speculative investments in internet-related companies led to massive overvaluation in the tech sector. Hype around “dot-com” startups drove stock prices to unsustainable levels.

Impact: The NASDAQ index plummeted by nearly 80%, causing trillions of dollars in losses and leading to bankruptcies among numerous internet startups. The burst destabilized investor confidence in the tech sector and led to widespread layoffs.

Aftermath: This crash sparked regulatory reforms, including the Sarbanes-Oxley Act, to increase corporate transparency and accountability. The tech sector underwent a period of consolidation, and investors became more cautious, assessing technology stocks with a stronger focus on fundamentals.

3. 2007–2008 Global Financial Crisis

Cause: Excessive risk-taking in the U.S. housing market, fueled by subprime mortgages and the proliferation of complex derivatives, created a massive bubble. When housing prices fell, defaults surged, and financial institutions faced insolvency.

Impact: The crisis plunged the world into a severe recession, triggering widespread bank failures, stock market crashes, and high unemployment rates globally. The economic turmoil extended to Europe and Asia, revealing systemic weaknesses in global finance.

Aftermath: Governments and central banks intervened with bailouts, stimulus packages, and quantitative easing. New regulations, such as the Dodd-Frank Act in the U.S., aimed to curb risky financial practices and prevent future crises.

4. 2010–2015 European Debt Crisis

Cause: The 2008 financial crisis exacerbated existing debt issues in Eurozone countries, particularly in Greece, Italy, Spain, Portugal, and Ireland. High debt levels, combined with slow growth, created a precarious economic situation.

Impact: The crisis led to a series of bailouts by the European Central Bank (ECB) and the International Monetary Fund (IMF), particularly for Greece. Austerity measures were implemented, but they triggered protests, political instability, and prolonged economic stagnation in affected countries.

Aftermath: The European Stability Mechanism (ESM) was established to provide financial assistance to Eurozone countries. The crisis reinforced the importance of fiscal discipline within the EU, though Southern European nations continued to struggle with high debt levels and slow growth.

5. Chinese Stock Market Crash (2015)

Cause: A speculative stock market bubble developed in China, fueled by rapid economic growth and excessive margin trading. When prices began to correct, panic ensued among retail investors.

Impact: China’s stock market fell by about 30%, sparking volatility in global markets. Commodity prices dropped, affecting trade partners and emerging markets linked to China’s economy.

Aftermath: The Chinese government injected liquidity into the markets and restricted trading to stabilize the economy. The crash highlighted risks within China’s financial system and led to greater emphasis on regulatory controls to prevent future bubbles.

6. Brexit Referendum (2016)

Cause: The United Kingdom voted to leave the European Union, driven by political and economic discontent, concerns over sovereignty, and debates on immigration and economic policy.

Impact: The referendum’s result sent the British pound tumbling and created uncertainty in trade, investment, and business operations between the UK and EU. Many companies reconsidered their operations in the UK, especially in finance.

Aftermath: Prolonged negotiations followed, leading to the UK’s official exit from the EU in 2020. New trade and investment agreements reshaped the UK-EU economic relationship, with ongoing challenges in sectors like manufacturing, agriculture, and finance.

7. COVID-19 Pandemic (2020–2021)

Cause: The COVID-19 virus spread globally, leading to lockdowns, travel restrictions, and disruptions across supply chains. The pandemic affected both consumer behavior and business operations on an unprecedented scale.

Impact: A sharp global recession ensued, with significant job losses, stock market fluctuations, and increased government spending to support affected industries and citizens. The impact varied by region and sector, with travel, hospitality, and retail hit hardest.

Aftermath: Governments introduced stimulus packages to support recovery, while vaccination programs gradually stabilized economies. The pandemic reshaped entire industries, pushing forward digital transformation and e-commerce while leaving long-term impacts on healthcare, travel, and retail.

8. Global Supply Chain Crisis (2021–2022)

Cause: COVID-19-induced disruptions, labor shortages, and high consumer demand led to severe bottlenecks in global supply chains. The interconnected nature of global production and logistics was strained by these pressures.

Impact: Shortages of critical goods like semiconductors and shipping delays contributed to inflation and disrupted industries from automotive to electronics. Shipping costs soared, impacting businesses and consumers alike.

Aftermath: Companies began reevaluating their supply chain strategies, focusing on resilience, diversification, and reshoring production to avoid future disruptions. Many countries encouraged domestic production of key goods to reduce reliance on global supply chains.

9. Ukraine-Russia Conflict (2022)

Cause: Russia’s invasion of Ukraine impacted global energy and food supplies, as both nations are major exporters of commodities like oil, natural gas, and wheat.

Impact: Energy prices surged, especially in Europe, which heavily relies on Russian gas. Food prices also increased, affecting developing nations reliant on Ukrainian grain. The conflict led to broader inflationary pressures and spurred shifts in global trade.

Aftermath: European countries accelerated their shift toward renewable energy to reduce dependency on Russian fuel. The conflict underscored the vulnerabilities in global commodity markets and the geopolitical risks tied to energy and food security.

Each crisis highlights the fragility of interconnected global economies, the risks of excessive debt, and the volatility of speculative investments. From these experiences, governments and institutions have strengthened regulations, prioritized economic resilience, and adopted new policy tools, all of which play vital roles in addressing future crises.

How to get ready and face them if it happen again - Major Economic Crises in the past three decades

Diversify Your Portfolio

- Why: Over-reliance on any one sector or asset type can be risky. During the crisis, investors heavily concentrated in real estate or financial stocks saw huge losses.

- How: Spread investments across various asset classes (stocks, bonds, real estate, commodities) and sectors to protect against downturns in any single area. Consider international diversification to reduce exposure to domestic economic risks.

2. Understand and Limit Leverage

- Why: Excessive leverage amplifies risks. Many institutions during the crisis were over-leveraged, which led to significant losses when asset values dropped.

- How: Avoid over-leveraging by not borrowing excessively to invest. Use leverage conservatively, and ensure your portfolio can handle unexpected downturns without forcing you into unwanted sales or significant losses.

3. Focus on Quality and Fundamental Value

- Why: Crisis periods reveal weaknesses in overvalued and speculative assets. Quality investments with strong fundamentals tend to withstand economic downturns better.

- How: Prioritize companies with solid balance sheets, low debt, and strong cash flows. Avoid “hyped” sectors or companies whose valuations seem disconnected from their actual earnings and revenue potential.

4. Watch for Warning Indicators

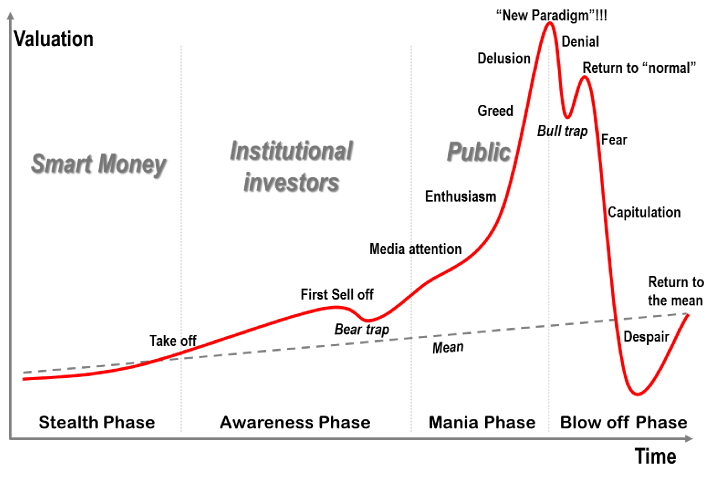

- Why: Pre-crisis signs often include unsustainable asset prices, high leverage, and complex financial products. Recognizing these can help you adjust your portfolio before markets turn.

- How: Pay attention to economic indicators, such as rising interest rates, high debt levels, or speculative bubbles (e.g., rapid price increases in real estate or certain stocks). Be cautious if markets start showing excessive risk-taking or “too good to be true” gains.

5. Maintain Liquidity and Emergency Cash Reserves

- Why: Liquidity enables you to withstand market downturns and avoid selling assets at a loss. Many investors suffered because they lacked liquidity during the 2008 crisis.

- How: Keep a portion of your portfolio in cash or liquid, low-risk assets. This gives you flexibility to buy undervalued assets during a crisis and protects you from having to sell at a loss.

6. Be Cautious of Complex Financial Products

- Why: Derivatives and complex financial instruments like Mortgage-Backed Securities (MBS) and CDOs masked significant risks during the crisis.

- How: If you don’t fully understand a product, avoid it. Stick to transparent investments with clearly defined risks. Be especially cautious with new, complex financial products.

7. Prepare for Long-Term Holding

- Why: Markets typically recover over the long term, even after severe downturns. Panic-selling often locks in losses.

- How: Invest with a long-term mindset. Avoid reacting emotionally to market volatility, and have a plan to hold through downturns. Regularly review your portfolio to ensure it aligns with your goals, but don’t let short-term turbulence drive decisions.

8. Stay Informed but Avoid Panic

- Why: A well-informed investor can spot potential risks, but panic often leads to poor decision-making.

- How: Follow credible financial news and trends, especially regarding economic stability, interest rates, and regulatory changes. However, avoid making knee-jerk reactions to sensational news. Focus on your strategy and principles.

9. Consider Defensive Investments During Uncertain Times

- Why: Defensive sectors (e.g., utilities, consumer staples) tend to perform better during economic downturns since they’re less affected by economic cycles.

- How: Allocate part of your portfolio to defensive sectors, particularly if you expect a recession. These sectors can offer stability and help offset losses in more cyclical investments.

10. Invest in Your Knowledge and Financial Literacy

- Why: Understanding market fundamentals, financial instruments, and historical crises will strengthen your decision-making and reduce the chance of falling into traps like overvaluation.

How: Continue learning about investing, crisis indicators, and economic history. Attend seminars, read reputable financial books, and stay curious about market trends.